Union Finance Minister, Nirmala Sitharaman, presented her last full-fledged Budget before the 2024 Lok Sabha Elections. In the backdrop of India’s GDP growth expected to remain at 7% in the coming year, the Budget 2023 seems to lay a firm foundation for Indian Economy with various policy measures to enhance ease of doing business, increased capital outlay, focus on education and healthcare, support to MSMEs, co-operatives, green growth etc.

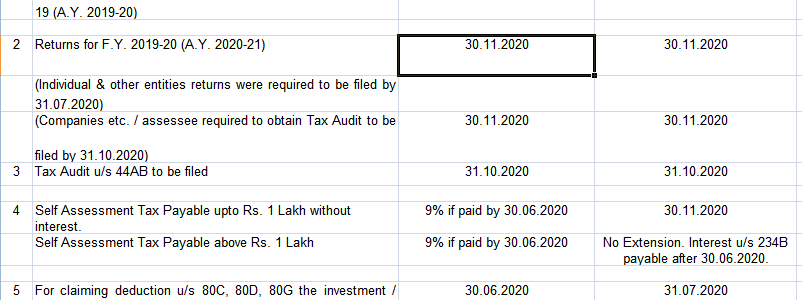

The tax proposals in the Budget aim towards ease of compliance, maintain consistency, rationalisation, widening of tax base and socio-economic welfare measures. Apart from the incentive to the taxpayers though rationalised slab rates and higher non-taxable limit of INR 7 lakhs, there are multiple initiatives in the fine print that target towards benefitting the businesses with simplified/ easy of compliance. The tax proposals further provide initiatives to support the MSMEs and the co-operative assessees. On indirect tax front also, the focus seems to be on rationalisation of provisions and rats.

Although satisfying every sector of the industry may not be possible still, overall the Budget 2023 continues to build on the foundation laid over the last decade aiming towards boosting the economy through multiple initiatives and proposals. Investor confidence in India is expected to gain strength and lead to a much more powerful Indian economy in future.